All Categories

Featured

Table of Contents

As certified financiers, individuals or entities may participate in private financial investments that are not registered with the SEC. These investors are presumed to have the financial refinement and experience called for to review and buy risky financial investment chances hard to reach to non-accredited retail capitalists. Here are a few to consider. In April 2023, Congressman Mike Flooding presented H.R.

For now, financiers need to comply with the term's existing definition. Although there is no official process or government qualification to become a certified financier, a person might self-certify as a certified investor under existing regulations if they earned more than $200,000 (or $300,000 with a spouse) in each of the past two years and expect the exact same for the present year.

People with an energetic Series 7, 65, or 82 license are additionally taken into consideration to be approved financiers. Entities such as firms, partnerships, and counts on can also achieve accredited investor standing if their investments are valued at over $5 million.

What is Accredited Investor Commercial Real Estate Deals?

Exclusive Equity (PE) funds have actually revealed impressive development in current years, apparently undeterred by macroeconomic challenges. PE firms pool funding from approved and institutional investors to get regulating passions in mature personal business.

In addition to resources, angel financiers bring their expert networks, support, and proficiency to the startups they back, with the assumption of endeavor capital-like returns if business removes. According to the Facility for Endeavor Research, the ordinary angel financial investment amount in 2022 was roughly $350,000, with capitalists getting a typical equity risk of over 9%.

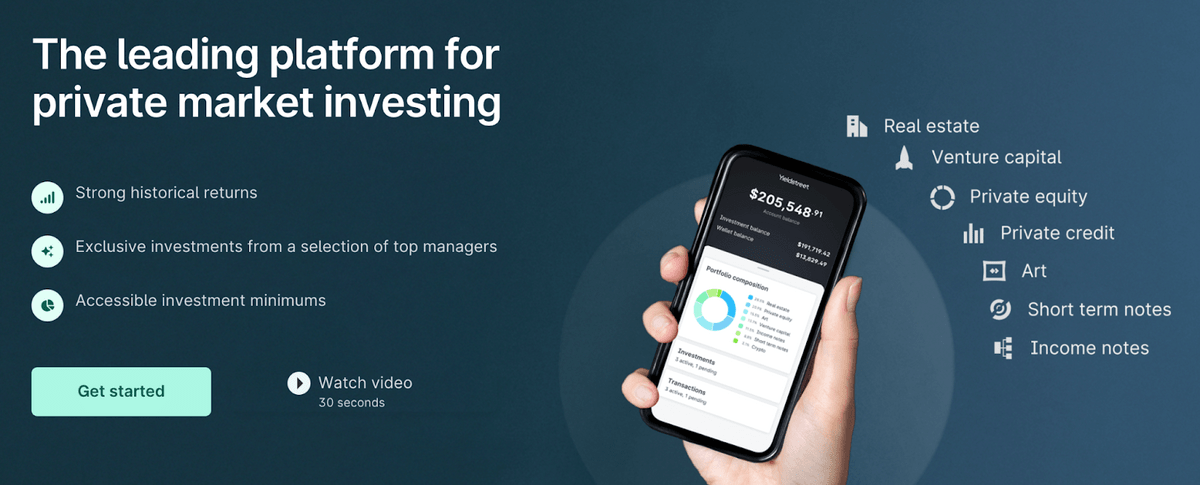

That claimed, the arrival of online personal credit rating platforms and specific niche sponsors has made the possession class available to individual recognized investors. Today, investors with as little as $500 to invest can take benefit of asset-based personal credit possibilities, which provide IRRs of approximately 12%. Despite the rise of e-commerce, physical supermarket still make up over 80% of grocery store sales in the USA, making themand especially the property they run out oflucrative investments for accredited capitalists.

In contrast, unanchored strip centers and area facilities, the next two most heavily negotiated types of property, recorded $2.6 billion and $1.7 billion in transactions, specifically, over the very same duration. But what are grocery store-anchored centers? Rural strip malls, outlet shopping centers, and various other retail centers that feature a major food store as the area's primary renter generally drop under this classification, although shopping malls with enclosed pathways do not.

To a lesser degree, this phenomenon is also true backwards. This distinctly cooperative connection between a center's lessees drives up need and maintains rents raised. Recognized financiers can purchase these areas by partnering with realty personal equity (REPE) funds. Minimum financial investments normally begin at $50,000, while overall (levered) returns vary from 12% to 18%.

What is the difference between Residential Real Estate For Accredited Investors and other investments?

The market for art is likewise expanding. By the end of the years, this figure is anticipated to approach $100 billion.

Capitalists can now possess diversified exclusive art funds or purchase art on a fractional basis. These options come with financial investment minimums of $10,000 and offer web annualized returns of over 12%.

If you've seen ads genuine estate financial investments, or any other form of investing, you might have seen the term "approved" prior to. Some financial investment possibilities will just be for "certified" financiers which are 506(c) offerings. This leads some people to think that they can not spend in genuine estate when they can (after all, "certified" appears like something you make or apply for).

How can I secure Accredited Investor Real Estate Syndication quickly?

Nonetheless, what happens if you intend to invest in a local business? Possibly there's a diner down the street that you intend to invest in to get a 25% equity risk. That diner, certainly, won't sign up with the SEC! That's where certified investing comes into play. That restaurant might get financial investments from certified financiers yet not nonaccredited ones.

Keeping that background in mind, as you could picture, when somebody obtains capitalists in a new apartment, they must often be approved. Nonetheless, similar to a lot of legislations, even that's not constantly the situation (we'll information a lot more shortly)! There are several forms of realty investing, though. A number of them are open to nonaccredited financiers (Accredited Investor Real Estate Crowdfunding).

How is that a nonaccredited genuine estate investing choice? The response depends on a nuance of the legislation. A nonaccredited actual estate financial investment possibility is a 506(b) bargain named after the area of the statute that accredits it. Syndications under this legislation can not openly market their securities, so it is called for that the sponsors (people putting the syndication together) have a preexisting relationship with the capitalists in the bargain.

Probably the most uncomplicated and user-friendly financial investment chance for a person who doesn't have certification is buying and holding rental residential or commercial property. Usually, residential property worths appreciate, and you can produce a consistent monthly revenue stream! Buying and holding rental properties is probably the most uncomplicated of all the unaccredited actual estate investing alternatives!

Component of the reason these shows are throughout is that turning does function mainly. You can locate homes cheaply, remodel them, and market them for a tidy profit if you recognize where to look. If you go behind the scenes on these programs, you'll typically recognize that these financiers do a lot of the work on their very own.

The concept behind this strategy is to keep doing the following action in sequence: Get a single-family home or condo that requires some work. Rehab it to make it both rentable and boost the home's value. Rental fee it out. Re-finance the building to take out as much of your initial resources as feasible.

Is Commercial Real Estate For Accredited Investors worth it for accredited investors?

Suppose you do not have that saved up yet however still wish to invest in realty? That's where REITs are powerful. Private Property Investment Opportunities for Accredited Investors. REITs are business that concentrate on property and profession on common supply exchanges. You can get them in your 401(k) or via any typical broker agent account. These companies commonly buy and run shopping malls, purchasing facilities, house buildings, and other large-scale realty financial investments.

Latest Posts

List Of Properties That Owe Taxes

Delinquent Property Tax Notice

Tax Delinquent Houses