All Categories

Featured

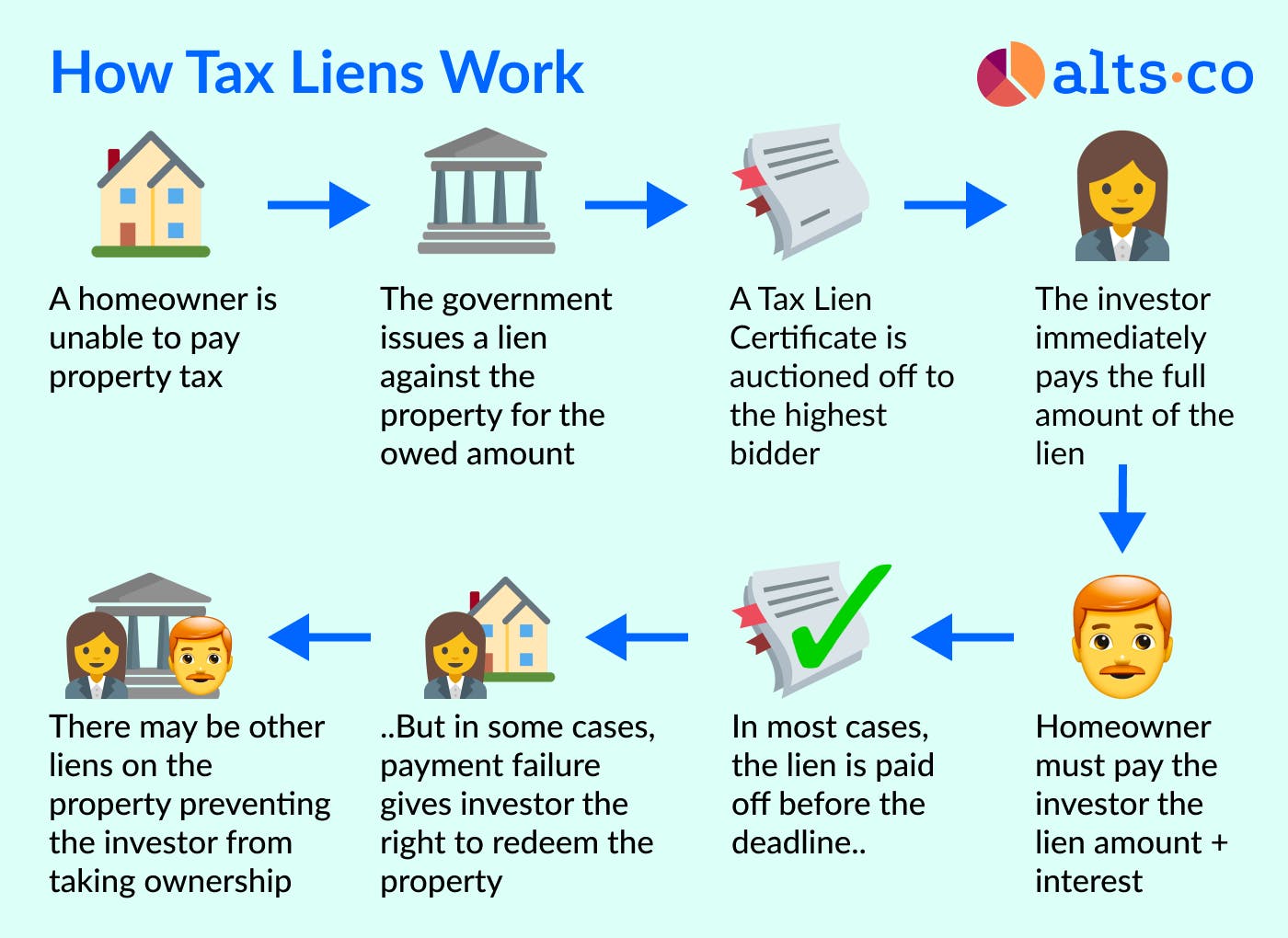

Investing in tax obligation liens through purchases at a tax obligation lien sale is simply that-a financial investment. All Tax Obligation Sales in Colorado are carried out per CRS 39-11-101 thru 39-12-113 Adhering to the tax lien sale, effective bidders will certainly obtain a duplicate of the tax lien certification of purchase for each property. Spending in tax obligation liens with purchase at the tax lien sale is simply that, a financial investment.

How To Invest In Tax Liens Online

When a property owner drops behind in paying residential property taxes, the region or community may place tax lien against the residential or commercial property. Rather of waiting for settlement of taxes, federal governments in some cases choose to offer tax obligation lien certificates to personal capitalists. Your earnings from a tax lien investment will certainly come from one of two sources: Either interest repayments and late fees paid by homeowners, or foreclosure on the building sometimes for as little as cents on the buck.

Latest Posts

List Of Properties That Owe Taxes

Delinquent Property Tax Notice

Tax Delinquent Houses