All Categories

Featured

In 2020, an estimated 13.6 million U.S. families are accredited investors. These homes regulate massive riches, approximated at over $73 trillion, which stands for over 76% of all personal riches in the U.S. These capitalists take part in investment chances generally unavailable to non-accredited investors, such as investments secretive business and offerings by particular hedge funds, private equity funds, and financial backing funds, which allow them to grow their wealth.

Check out on for information regarding the current certified financier revisions. Resources is the fuel that runs the economic engine of any kind of nation. Financial institutions typically money the majority, but seldom all, of the funding required of any purchase. There are situations like start-ups, where banks don't supply any kind of financing at all, as they are unverified and taken into consideration risky, but the need for resources stays.

There are mainly two guidelines that enable issuers of safety and securities to supply limitless quantities of safety and securities to capitalists. institutional accredited investor rule 501. One of them is Guideline 506(b) of Law D, which enables a company to sell securities to unrestricted recognized financiers and as much as 35 Advanced Financiers only if the offering is NOT made with general solicitation and basic advertising

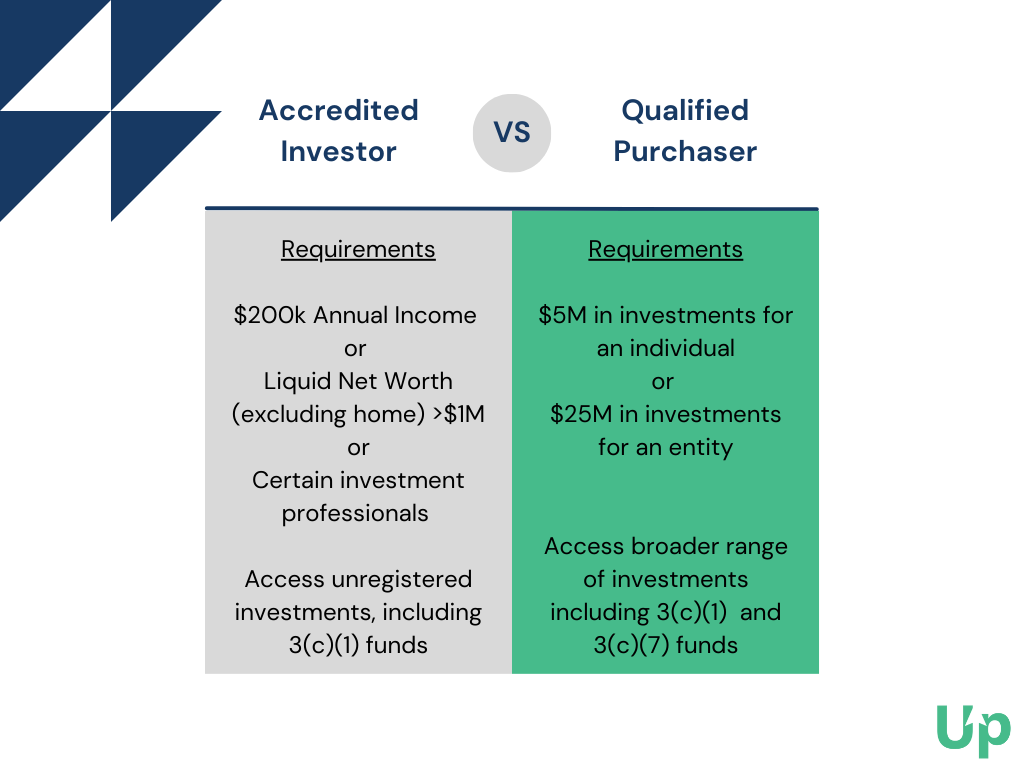

The recently taken on changes for the very first time accredit individual financiers based upon economic elegance needs. Several various other modifications made to Policy 215 and Guideline 114 A clarify and increase the list of entity types that can qualify as a certified investor. Below are a few highlights. The amendments to the recognized capitalist interpretation in Regulation 501(a): consist of as accredited financiers any type of depend on, with overall possessions greater than $5 million, not created particularly to acquire the subject safeties, whose purchase is directed by an advanced individual, or consist of as accredited capitalists any type of entity in which all the equity owners are approved capitalists.

And since you understand what it means, see 4 Realty Marketing strategies to draw in certified capitalists. Website DQYDJ ArticleInvestor.govSEC Proposed modifications to interpretation of Accredited InvestorSEC improves the Accredited Capitalist Interpretation. Under the federal safeties laws, a business may not provide or offer securities to financiers without enrollment with the SEC. There are a number of registration exemptions that ultimately expand the cosmos of prospective investors. Numerous exceptions call for that the investment offering be made only to individuals who are accredited financiers.

Additionally, certified capitalists often receive much more desirable terms and greater potential returns than what is readily available to the public. This is since private positionings and hedge funds are not required to follow the exact same governing requirements as public offerings, enabling more versatility in regards to investment methods and prospective returns.

Accredited Investor Hedge Fund

One factor these security offerings are limited to recognized investors is to make certain that all getting involved capitalists are financially advanced and able to fend for themselves or maintain the danger of loss, hence rendering unnecessary the defenses that come from a registered offering. Unlike protection offerings registered with the SEC in which specific details is needed to be revealed, companies and private funds, such as a hedge fund - regulation d accredited investors or venture resources fund, involving in these excluded offerings do not have to make recommended disclosures to certified financiers.

The net worth test is fairly easy. Either you have a million bucks, or you do not. On the income test, the person must please the thresholds for the 3 years consistently either alone or with a partner, and can not, for instance, satisfy one year based on individual income and the following two years based on joint earnings with a partner.

Latest Posts

List Of Properties That Owe Taxes

Delinquent Property Tax Notice

Tax Delinquent Houses