All Categories

Featured

Table of Contents

Accredited capitalists have access to investment chances that are used privately under Law D of the Stocks Act. These are not openly provided chances offered to the basic spending public - accredited investment management. Normally, these financial investments can be riskier, but they provide the opportunity for possibly higher returns. Historically, the SEC difference was to mark individuals that are considered to be much more sophisticated capitalists.

Personal firms can offer protections for investment that are not readily available to the public. These safety and securities products can consist of: Equity capital Funds (VC)Angel InvestingHedge FundsPrivate Equity OpportunitiesEquity Crowdfunding There are likewise additional private financial investment protections that can be accessed by certified capitalists. The meaning and needs of this sort of investor certification have remained top of mind since its beginning in the 1930s.

Qualified Investor

These demands are intended to ensure that capitalists are educated adequate to recognize the threats of these financial investment opportunities. They additionally work to make sure that potential financiers have sufficient wealth to secure against financial loss from riskier financial investments. Today, the criteria for recognized financiers remain to be a warm subject.

Others think that recognized status should be based on their investing acumen (investor test). Or rather, a combination of such expertise and wide range rather than being just wealth or income-based. Also though these parameters have actually lately altered, there are some that want the needs to minimize even additionally. This will certainly proceed to be a fiercely debated topic among the monetary crowd.

Non-accredited financiers were initial able to invest in the Fund in August 2020. Certified financiers might participate in all our financial investment items with their Yieldstreet IRA.

As for exactly how much this will certainly affect the market relocating forward, it's most likely also very early to tell. When even more and a lot more qualified financiers look for certification, it will be easier to identify how this new ruling has actually broadened the market, if at all.

Earn Your Accredited

Capitalists must meticulously take into consideration the investment purposes, threats, costs and expenses of the YieldStreet Choice Income Fund before spending. The program for the YieldStreet Alternative Income Fund contains this and various other details about the Fund and can be obtained by referring to . The prospectus ought to be reviewed meticulously before purchasing the Fund.

The safety and securities described in the program are not used for sale in the states of Nebraska, Texas or North Dakota or to individuals resident or located in such states (llc accredited investor). No membership for the sale of Fund shares will be approved from anyone homeowner or situated in Nebraska or North Dakota

(SEC).

The needs of that can and who can not be an approved investorand can take component in these opportunitiesare determined by the SEC. There is an usual misconception that a "process" exists for a specific to become an accredited capitalist.

Find Accredited Investors

The concern of verifying a person is an accredited capitalist drops on the financial investment vehicle instead of the financier. Pros of being an accredited investor include accessibility to unique and limited financial investments, high returns, and enhanced diversification. Disadvantages of being an approved investor include high threat, high minimal investment amounts, high costs, and illiquidity of the investments.

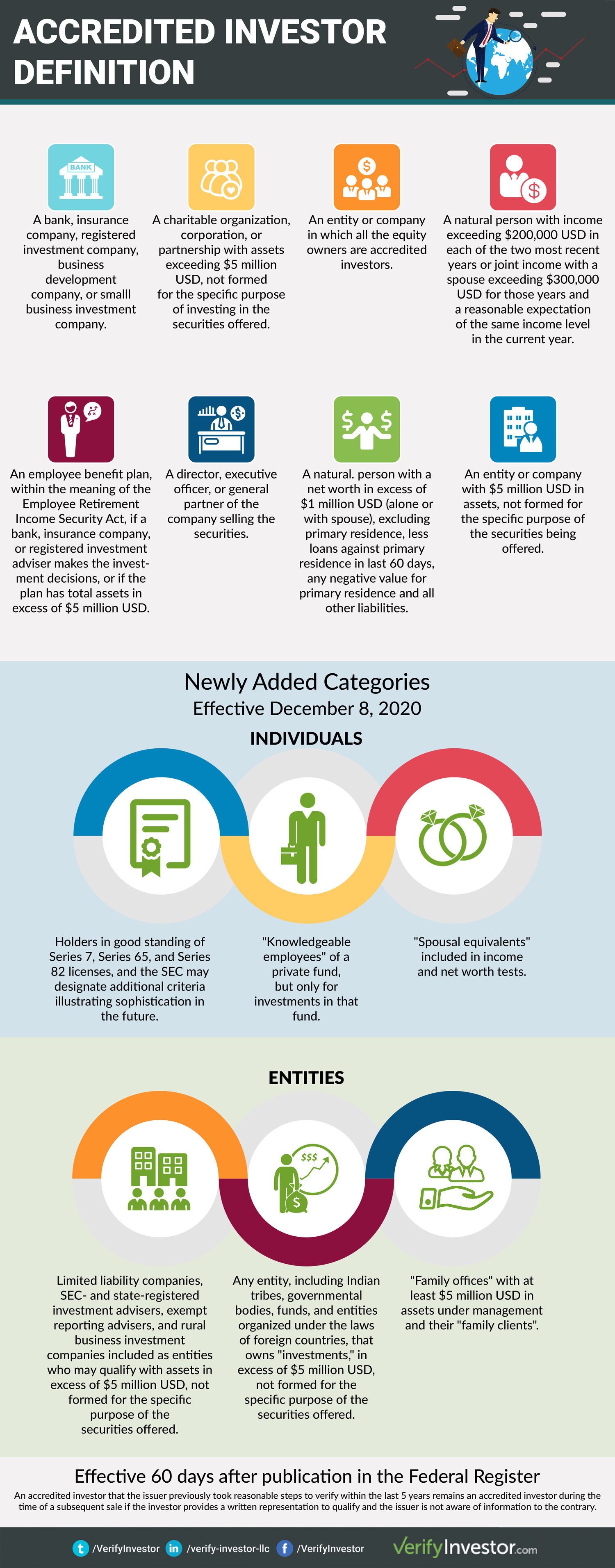

Rule 501 of Law D of the Securities Act of 1933 (Reg. D) provides the meaning for a recognized capitalist. Put simply, the SEC specifies a certified investor with the boundaries of earnings and web worth in 2 ways: A natural individual with earnings exceeding $200,000 in each of both latest years or joint earnings with a spouse surpassing $300,000 for those years and a sensible expectation of the same revenue level in the existing year.

About 14.8% of American Households qualified as Accredited Investors, and those houses regulated roughly $109.5 trillion in riches in 2023 (definition of accredited investor). Gauged by the SCF, that was around 78.7% of all exclusive wealth in America. Regulation 501 likewise has provisions for companies, partnerships, philanthropic organizations, and rely on enhancement to company supervisors, equity proprietors, and banks

The SEC can include accreditations and designations going forward to be included in addition to motivating the public to send proposals for various other certifications, classifications, or qualifications to be considered. Staff members that are taken into consideration "well-informed staff members" of an exclusive fund are currently also considered to be approved investors in relation to that fund.

Individuals that base their certifications on annual income will likely require to submit tax obligation returns, W-2 types, and various other documents that suggest wages. Individuals might likewise take into consideration letters from reviews by Certified public accountants, tax lawyers, financial investment brokers, or consultants. Recognized investor designations likewise exist in other countries and have comparable demands.

Accredited Investor Under Regulation D

In the EU and Norway, as an example, there are 3 tests to identify if a person is an accredited financier. The first is a qualitative test, an examination of the person's proficiency, knowledge, and experience to establish that they can making their very own financial investment decisions. The 2nd is a quantitative examination where the individual has to fulfill two of the complying with requirements: Has brought out transactions of significant dimension on the pertinent market at an ordinary regularity of 10 per quarter over the previous 4 quartersHas a monetary portfolio going beyond EUR 500,000 Works or has actually operated in the economic sector for at the very least one year Last but not least, the customer needs to state in written kind that they wish to be dealt with as a professional customer and the firm they desire to do company with must offer notification of the protections they might shed.

Pros Accessibility to even more investment possibilities High returns Boosted diversity Cons Risky investments High minimum financial investment amounts High performance fees Long capital secure time The primary advantage of being an approved investor is that it provides you a financial advantage over others. Because your internet worth or salary is currently among the highest possible, being a recognized capitalist permits you accessibility to financial investments that others with much less wide range do not have access to.

Qualified Purchaser Verification

These financial investments could have greater prices of return, far better diversity, and numerous various other features that assist develop riches, and most notably, construct wide range in a much shorter time framework. Among the simplest instances of the advantage of being a certified financier is being able to buy hedge funds. Hedge funds are mostly only obtainable to recognized capitalists due to the fact that they require high minimal investment quantities and can have higher affiliated dangers yet their returns can be extraordinary.

There are also cons to being an accredited capitalist that connect to the financial investments themselves. A lot of financial investments that require an individual to be a recognized investor featured high threat. The strategies employed by several funds included a higher threat in order to achieve the objective of beating the marketplace.

How To Become A Private Investor

Merely depositing a few hundred or a couple of thousand bucks right into an investment will certainly not do. Certified financiers will certainly have to devote to a few hundred thousand or a couple of million dollars to take part in financial investments meant for accredited capitalists (sec sophisticated investor definition). If your financial investment goes southern, this is a whole lot of cash to lose

These mainly can be found in the form of efficiency costs along with management costs. Efficiency costs can vary between 15% to 20%. An additional con to being a certified investor is the ability to access your financial investment resources. If you acquire a few supplies online through an electronic platform, you can pull that cash out any type of time you such as.

A financial investment automobile, such as a fund, would certainly have to determine that you certify as an approved investor. The advantages of being a recognized investor include access to distinct investment possibilities not offered to non-accredited capitalists, high returns, and increased diversity in your profile.

In certain areas, non-accredited financiers additionally have the right to rescission. What this suggests is that if an investor decides they wish to take out their cash early, they can assert they were a non-accredited investor the whole time and obtain their refund. Nonetheless, it's never ever a good idea to supply falsified files, such as phony income tax return or economic statements to an investment automobile just to invest, and this could bring legal trouble for you down the line.

That being stated, each offer or each fund might have its own constraints and caps on financial investment amounts that they will approve from a capitalist. Accredited capitalists are those that meet certain demands regarding earnings, qualifications, or internet worth.

Latest Posts

List Of Properties That Owe Taxes

Delinquent Property Tax Notice

Tax Delinquent Houses